Who owns the ‘T’ of the Aye Aye Oh Tee!

The new year’s got McRock Capital’s Research Squad cracking its knuckles, ready to crystal ball the biggest trends that could influence the Industrial Internet of Things (IIoT) in 2020.

Now that the hoopla around IoT has settled, a lot of companies have started treating it as less of a buzzword and more of a way to accelerate their growth trajectory. Consequently, we’ve identified five trends we think will dominate the industry this year, transforming the digital landscape as we know it.

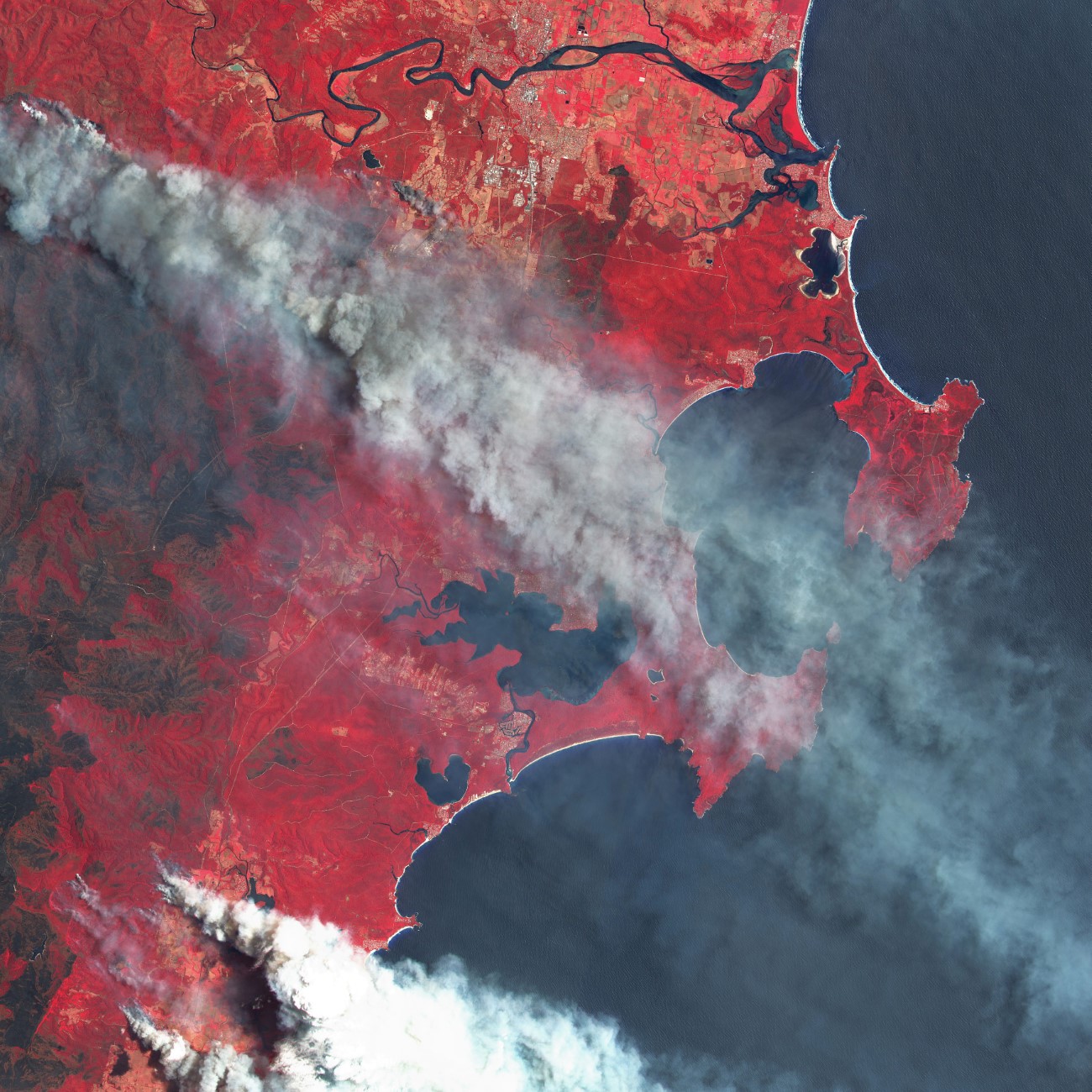

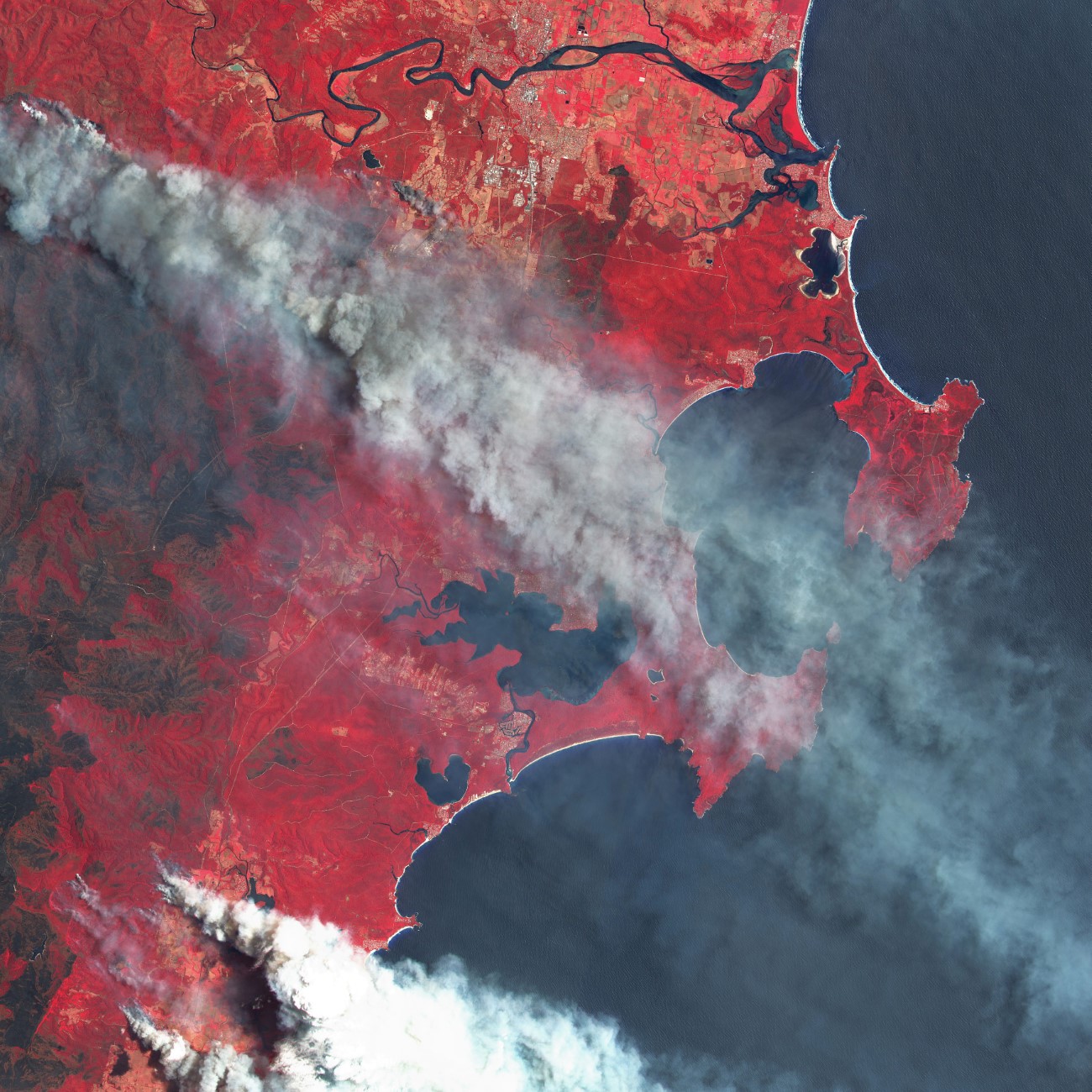

IoT and ClimateTech—Mother Earth is on FIRE

Mother Earth is heating up in an unprecedented way; it’s DEFCON 1, people!

As more countries start to take the threat seriously and strive towards sustainability, green technology is expected to take the lead in reducing waste and energy consumption while facilitating effective resource utilization. However, the high cost of implementation and dearth of awareness can impede the growth of the green technology and sustainability market. To combat this, we expect Industrial IoT to play a major role, since its entire premise is based on improving productivity, reducing uncertainty and providing greater visibility to all stakeholders.

Several Industrial IoT solutions have the potential to optimize processes, streamline operations, reduce emissions and create a positive impact on the environment. Take agriculture for instance. By employing ground humidity sensors and leveraging environmental data, farmers can accurately gauge the amount of water required to irrigate their land, minimize the use of exorbitant chemical products and increase crop output.

In a similar vein, electricity demand for a city or an industrial complex can be anticipated so that requisite energy is delivered to less populated areas. Even waste management is being revolutionized, thanks to cyberphysical systems. For example, Songdo, a smart city in South Korea, has integrated IoT and sensors to bolster its waste management system. In fact, the city aims to recycle 76% of its waste by 2020.

We think corporations, governments, and tech companies are well on their way to partnering like never before to play their part in making a difference. Solutions addressing electrification in mobility, adaptive traffic control to reduce emissions in megacities, and waste management will gain unprecedented attention in 2020.

Predictive Maintenance #FTW—I Appeared, I Predicted, I Solved

With predictive maintenance and Industrial IoT working in tandem, disparate systems and assets can connect, capture, identify, share, analyse and act upon data that require attention.

We crafted the body of the IoT over the past decade, now we are building its mind.

Predictive maintenance, which employs condition-monitoring equipment to evaluate performance in real-time, is not a new concept. However, the key to optimizing it is IoT. With predictive maintenance and Industrial IoT working in tandem, disparate systems and assets can connect, capture, identify, share, analyze and act upon data that require attention.

At the risk of sounding poetic, predictive maintenance is the utopia of asset optimization—a beautiful dream that all operators and CxOs in the industrial space fantasize about.

Since the inception of McRock Capital in 2012, we have tracked the number of sensors that have been shipped. Their Compound Annual Growth Rate (CAGR) has finally come down from its previous triple-digit growth to 92%. Moreover, we have also seen machine-to-machine (M2M) communication soar. To us, this signifies that industrial machines and devices are now equipped with sensors and can communicate with the web by themselves.

Thanks to a surge in predictive maintenance, we can now start making sense of data using Artificial Intelligence (AI) and Machine Learning (ML) models. Rest assured, though, machine whisperers (aka plant operators) are not being replaced, just augmented, as predictive maintenance solutions will continue to evolve and become part of the overall maintenance workflow.

In fact, with better quality of data and advanced AI and ML models, the workflow will become semi-supervised, and inevitably, unsupervised. In simple terms, we won’t have to pore through data as much as we have in the past. The software will figure it out by itself. Predictions will become much more accurate, insightful and faster than we have ever experienced.

The Future is 5G–Mo’ G’s, not Emojis😀😃😄😁😆😅😂🤣😊😇🙃

5G, in congruence with IoT, is already powering the Fourth Industrial Revolution; much like steam, electricity, and silicon powered the previous three.

There’s a storm coming, Mr Wayne. It’s called 5G.

The ubiquitous smartphone and the advent of 4G have already metamorphosed the way we communicate. With 5G, we are on the threshold of the next generation of mobile communication. 5G, in congruence with IoT, is already powering the Fourth Industrial Revolution; much like steam, electricity, and silicon powered the previous three. This revolution is blurring the divide among the physical, biological and digital worlds that comprise AI, 3D printing, genetic engineering, and varied technologies. With enhanced capacity and accelerated response time, 5G is a solid foundation for this transformation.

We predict that this year, the private adoption of 5G will accelerate and take over its public deployment, yet have more machines as its customers than humans. Billions of devices will come to life, connect and exchange data at speeds we’ve never experienced. The biggest reason 5G networks will demand AI to do so is that they’re much more complex than previous-generation networks. In November 2019, multinational networking and telecommunications giant Ericsson estimated that by the end of 2025, 5G will have 2.6 billion subscriptions covering up to 65% of the world’s population. It went on to state that the number of cellular IoT connections will reach 5 billion worldwide, up from 1.3 billion then. If that’s the number of connections humans will use, think of the number machines will. Unimpressed? What if we tell you that there are about 38.5 billion connected IoT devices worldwide as compared to 9.5 billion mobile phones right now?

Let that sink in. Not only will the smart brick in your hand connect to 5G, but so will everything from autonomous vehicles and robots to industrial pumps. Industrial and urban infrastructure will enable the 5G network and influence the rollout of Automated Guided Vehicles, real-time edge analytics for more secure operations, video surveillance, etc.

Industrial Robotics will Transcend the Everyday–Domo Arigato, Mr Roboto

Industrial robots are transcending the world of manufacturing and supply chain/logistics because they have proven their worth in addressing the labour shortage and undertaking perilous tasks.

The robots are coming and the industrial jobs they are doing may surprise you!

Industrial robotics has remarkably changed in the past few decades. Customarily, robots are tailored for a certain task at hand, and industrial robots have revolutionized the manufacturing industry because they offer several bottom-line benefits. At the top of this list is efficiency. The robots synthesize speed and uptime to bring about higher production capability at reduced costs.

Moreover, industrial robots, when programmed accurately, are scalable—vastly improving the consistency of production, the quality of the product, and helping reduce waste. They also deliver excellent returns on investment (ROI) despite the high initial cost.

These robots are now transcending the world of manufacturing and supply chain/logistics because they have proven their worth in addressing the labour shortage and undertaking perilous tasks. However, in emerging markets, where robots have not yet made a disruptive impact, robotics companies can still get by with single-point solutions.

Either way, industrial robots will eat away at cobots in conventional industries. New sensors that can be applied to faster industrial robots will make them smarter, reliable and more cost-efficient. A word of warning to our little cobot friends: resistance is futile.

Edge Computing will Bring the World Closer–The Scorpions got it right… We are Walking on the Edge

Self-driving cars are an excellent example of edge computing as Tesla’s Model X autopilot controls the distance from the lead car and centres the vehicle in the lane.

Who’d a thunk that the 80s anthem will be so relevant in the industrial context by 2020?

For our intents and purposes, ‘edge’ refers to literal geographic distribution. So edge computing is just computing that takes place at or near the data’s point of origin, rather than in the cloud. But fear not, the cloud is not going away any time soon; in fact, it is coming closer to you by transforming the way data from millions of devices around the world are processed. The dramatic growth of IoT and a slew of new apps needing real-time computing power is powering edge-computing systems.

Edge computing has gained momentum, as evidenced by the recent acquisition of the edge AI startup, Xnor, by Apple. Despite the current shift from centralised/cloud to edge architecture, the two share a symbiotic relationship. The faster network of today (to which 5G is a contributor) facilitates edge-computing systems to support real-time applications.

As we process and compute more data in real-time, edge computing will become more pervasive in the industrial setup and enable the execution of most mission-critical processes and functions, including self-driving cars and video analytics.

So, here we are, on the Edge with our 5Gs and Predictions. Mother Earth, forgive us. Mr Roboto, help us. Time to roll up our sleeves and dedicate 2020 to individuals and organizations that have the courage to do their part and change the world.

Author: McRock Research Squad