Large corporations have recognized for decades that innovation is critical to growth and success. In more recent years, corporations have divorced themselves from the “not invented here” hubris of the past as the world has witnessed industry titans fall to technology innovation spawned outside the corporate wall.

In fact, globally Corporate VC (CVC) has been on a tear since 2009. Over 200 CVC groups have been launched since that time from companies such as Rogers Communications, GM Ventures, Comcast and Google. Some of the most established CVCs like Intel, Cisco, Shell, Qualcomm Ventures and Chevron Technology Ventures have been active investors for decades. Just yesterday Chevron Technology Ventures announced it closed its fifth fund.

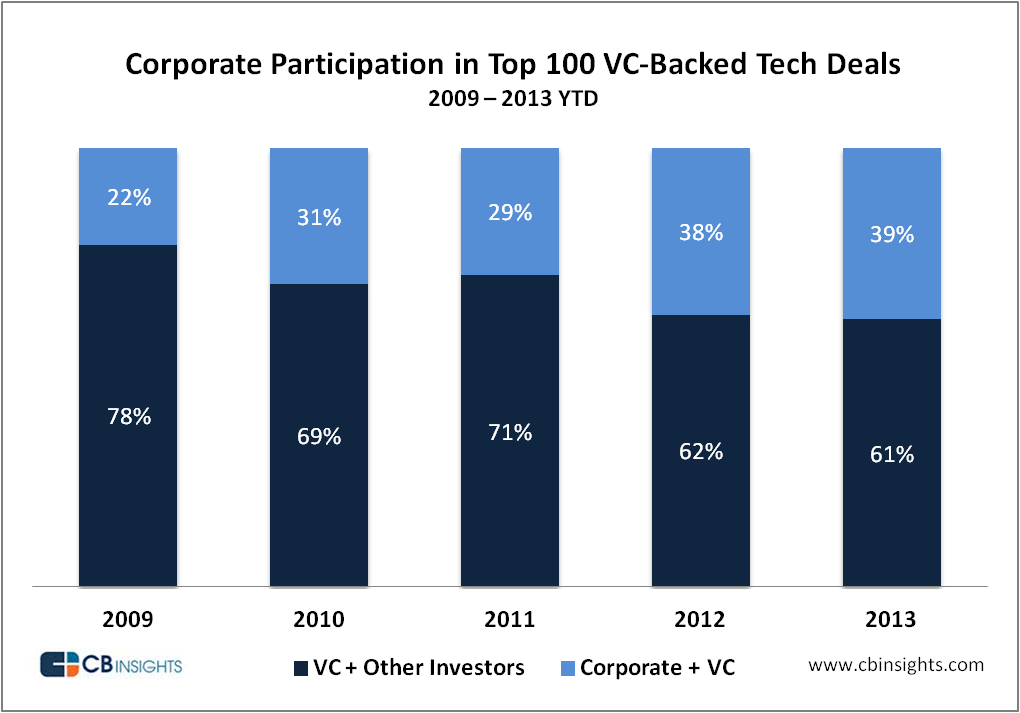

With the traditional venture capital industry contracting both by number of active firms and total assets under management, CVC has helped to fill the funding gap for start-ups and especially expansion stage capital. According to CB Insights, an analysis of the 100 largest tech deals over the past 5 years highlights the huge increase in corporate participation. CVCs participated in nearly 40% of the largest tech VC deals in 2012, up from 22% in 2009. CVCs are on track to do the same or more in 2013.

CVC groups like Google Ventures have led some of the larger financings in recent history like Uber’s $258 million round. There has certainly been some debate in the VC industry about the alignment of interest, or lack thereof, between the entrepreneurs and the CVCs. Perhaps Union Square’s Fred Wilson has been one of the most critical of CVCs. Like it or not, the VC industry needs the corporate balance sheet right now and most CVCs contribute invaluable market domain expertise to their portfolio companies. Not to mention the significant credibility a small company instantly inherits when it lands a large corporation as an investor. We call this the “Meatball Logo Effect” named affectionately after GE’s circular logo.

In our view, there is often a misunderstanding about a CVC’s strategic objectives and why they are actually not at odds with the entrepreneur or VC. We know firsthand because we have worked for both CVC units and traditional VC funds. Our experience is drawn from having co-invested in venture-backed companies and having CVCs as limited partners in our VC funds. These corporations include Bosch, John Deere, Volvo, Chevron and Dow. With this knowledge we want to help entrepreneurs understand the goals of CVCs and explain how they can work with strategic corporations to drive significant value for their small but growing companies.

There are three key goals for CVC groups: Strategic Return, Market Intelligence and Financial Return. They all matter to the corporation but some matter more and most importantly, all can be incredibly helpful to a venture-backed company.

Strategic Return is a fundamental corporate requirement to develop profitable business opportunities that capitalize on emerging products or services in adjacent or core markets. This requires close alignment with the relevant business units in an effort to reduce costs and/or grow revenue within the corporation. As long as entrepreneurs and Boards of the venture-backed companies make sure this relationship is also profitable for them, this corporate goal can result in an attractive channel to market.

Market Intelligence is a two-way street for both the corporation and the venture-backed company. The CVC group expects to gain a proprietary window on markets, companies and products through its corporate venturing activities. The venture-backed company can also access significant intelligence as it becomes part of the extended corporate family. A traditional VC Fund with corporate investors can also give a venture-backed company access to an extended corporate family without having the CVC group invest directly. For this reason, it is valuable for an entrepreneur to understand the investors behind a traditional VC Fund.

Financial Return is simply an expectation but perhaps not as important as Strategic Return. This is because the absolute dollar return from a CVC group, even if it delivers a monster return multiple, will likely be too small to have a financial impact on the corporation. But beware, no corporate executive will support a CVC group that does not deliver positive returns. Some have made the case that CVCs are less sensitive to valuation but based on our experience, most CVCs are very clinical in their valuation methodologies and any complaints from VCs made around lack of focus on financial return are made out of competitive frustration.

Despite the occasional mud slinging and paranoia towards CVCs’ true motives, they actually have much to offer venture-backed companies and their traditional VC investors. We have had great success partnering and co-investing with large corporations and encourage every small company to find a meatball logo to invest in them.

Author: Scott MacDonald, Co-founder & Managing Partner, McRock Capital